Media Releases

Windfall Gains Tax Good for Regional Communities

Media release: Windfall Gains Tax Good for Regional Communities. Tomorrow (16 November) the Victorian Parliament will vote on legislation to introduce a Windfall Gains Tax.

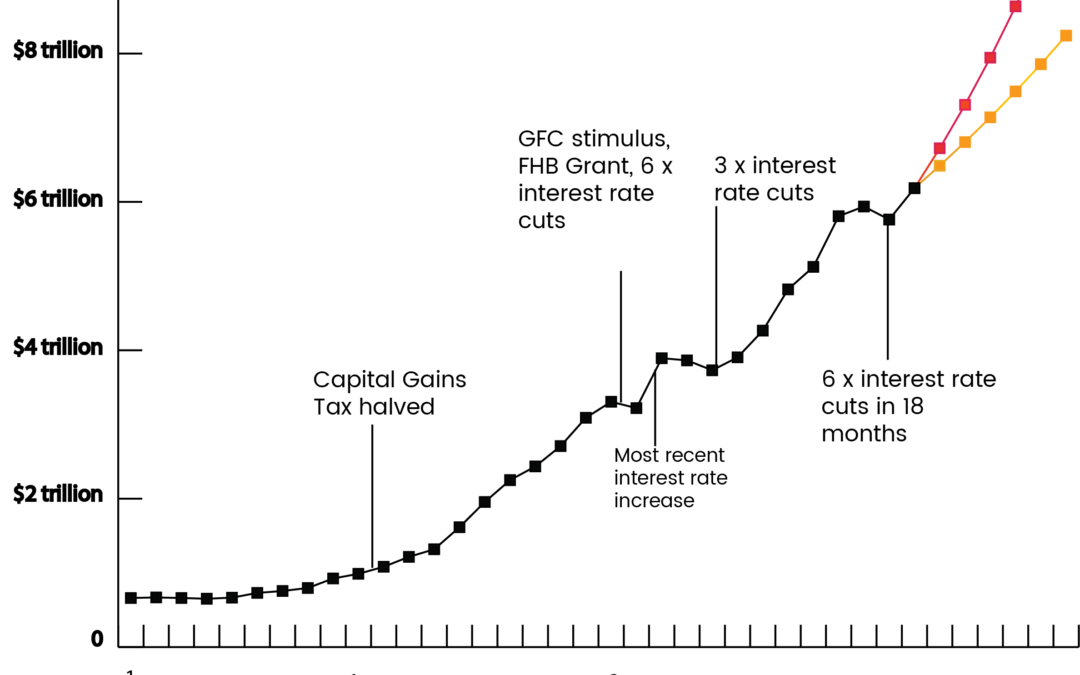

Australia’s land prices are out of control

Media Release A Housing Affordability nightmare - Australia’s land prices are out of control Today’s national accounts revealed record land price inflation - triple the highest ever previously recorded. The cost of land in Australia has gone up by $1.72 trillion,...

Win for all Victorians!

Media Release Win for all Victorians! New legislation will stop landholders walking away with huge windfall profits from rezoning The Victorian Government has announced it will introduce a tax on rezoning windfalls, something Prosper Australia has been encouraging for...

The Potential of a Rezoning Windfall Gains Tax

Media Release REZONING WINDFALLS COULD FUND RECORD PUBLIC HOUSING SPEND EACH YEAR A new report on landholder profits following the rezoning of the Fisherman’s Bend precinct showed an average 368% windfall gain per square metre, or $4.43bn. Prosper Australia research...

With Great Reward, Comes Great Responsibility

LAND TAX DRIVES STABILITY Changes to land tax and the introduction of a windfall gains tax will drive stability in the Victorian housing market, according to Victorian economics research group Prosper Australia. Prosper advocacy director Karl Fitzgerald says the...

States drive sustainable tax reform

Until recently, no government had a “cogent plan” to deal with impending combustion of Commonwealth fuel excise revenue. But now Victorian Treasurer Tim Pallas has risen to the challenge both to future proof Victoria’s road charging regime, and make Zero and Low...

Runaway Land Prices a National Economic Emergency

Politicians must act to show genuine leadership • Land prices to rise 65% in 5 years • Mortgage and residential rent burden to increase, less for small business • Inequality determined by property ownership Rising land prices are a national economic emergency,...

Housing vacancies continue to increase as land price booms

Vacant Residential Land Tax is ineffective in curtailing property vacancies in Melbourne. Policy must prioritise housing as a human right, not a profit generating tool. Budget housing policy will drive up land prices, countering the need for fairer post-covid housing...

Vic Budget: Stamp Duty Exemptions Irresponsible

The Andrews’ government has heeded calls to ensure all Victorians have access to housing with today's Victorian budget. Expanding public sector housing on public land is the right move. Exempting new buyers from stamp duty is the wrong move. “The Pallas budget could...

8 Years on, Homebuyers Winning from ACT’s Pioneering Tax Reforms

A new report for Prosper Australia finds the ACT government’s twenty-year tax reform program is achieving more than its three key aims of predictability, efficiency and equity. Read the report . Prosper Australia Research Director, Karl Fitzgerald said: “The...