Politicians must act to show genuine leadership

• Land prices to rise 65% in 5 years

• Mortgage and residential rent burden to increase, less for small business

• Inequality determined by property ownership

Rising land prices are a national economic emergency, according to economic think tank Prosper Australia, which says the runaway nature of land is placing a cost burden on the entire economy.

Prosper Australia director Karl Fitzgerald says “the RBA has thrown fuel on the housing fire with its willingness to cut interest rates aggressively, but refuses to increase them when the property market booms. 2016-17 saw the second largest increase of land prices on record but the RBA sat on its hands.

“This suggests an underlying economic fragility tied to the strain high rental and mortgage costs place on consumer demand and business resilience.

Such land and housing price pressures are expected to continue.

“The best Australia can expect is between 33 – 65% for total land price inflation – over just the next five years” says Mr Fitzgerald.

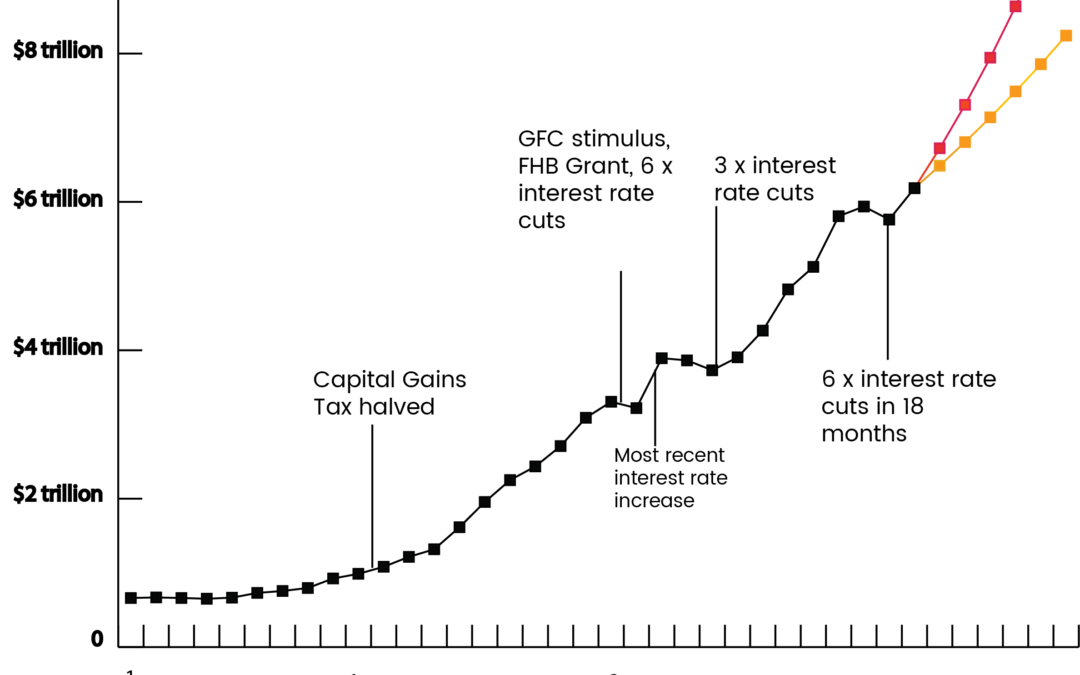

As demonstrated in the above graph, these figures are based on past land price growth rates extrapolated from the national accounts (ABS 5204061).

“The last decade’s increase in national land values averaged 4.9% per annum. If this trend continues, Australia’s total land values will increase from $6.2 trillion to $8.2 trillion in the next five years.

“Last FY land prices increased a colossal $423 billion, twenty times total banking profits. We expect land prices to increase by close to $600 billion this FY on the back of extensive government intervention in the market.

“The Federal government’s halving of the Capital Gains Tax heralded a seismic change in the way investors viewed housing. Now, despite the damage being done by our national obsession with property, policy makers are unwilling to wind back the tax policies that turned housing into just another commodity.

“The nation’s largest asset class – land – is sprinting ahead of what society can rationally afford, but our politicians have barely raised a sweat.

Young families, single women priced out of the market

“This is a land price inflation emergency. Ownership rates in the crucial family formation years of 25-34 are plummeting (down 12%). Single women over 55, our mothers and grandmothers, should not be in fear of homelessness, but are increasingly so.

“Political inertia makes it more likely that land price increases will track the higher 20 year average growth rate of 8.7%. This would see land prices jump 65% to $10.2 trillion in 5 years, driving a further wedge between property owners and the property-less.

“When the largest asset class in the nation runs out of control, it has ramifications for everything we do.

“The government is in effect sanctioning more of our weekly wages to be directed towards the wealthiest in society through mortgage payments and residential rents, with less to be spent in local businesses. No one should be surprised that small business resilience and job growth continue to suffer.

“With wage growth rising just 1.4% over the last year and future land prices growing up to 6 times faster, potential home buyers will struggle to keep up with deposit requirements.

Inflation figures flawed

Mr Fitzgerald said “Land price inflation is largely excluded from our inflation statistics. This means policy priorities are often conflicted. Interest rate cuts are regularly made to support growth, but instead drive up land and housing prices. With real estate dominating bank lending, there is little additional lending to small business, the big growth driver. A vicious cycle ensues with further interest rate cuts driving an affordability crisis overlooked by inflation.

“Governments need to utilise fiscal policy to assist. They can do that by acting upon their own tax inquiries. A uniform answer amongst the multitude of tax inquiries has been the advocacy of higher land value taxes.

“The NSW government must be commended for proposing a transition away from stamp duties and towards land taxes.

“The fairest and most efficient means to contain runaway land prices is to transition the tax system away from income taxes and toward the taxation of land.

“The Federal government could move quickly to protect future generations from further damage by mandating a ceiling for mortgage contracts of 30 years. On current projections, it may not be long before we see 120-year mortgages, as in Japan.”

“Our politicians are acting as if money will fall out of the sky to pay for a primal human right – a place to live with dignity. We implore our leaders to act in the public interest by finally engaging in meaningful action based on past tax reviews” says Fitzgerald.