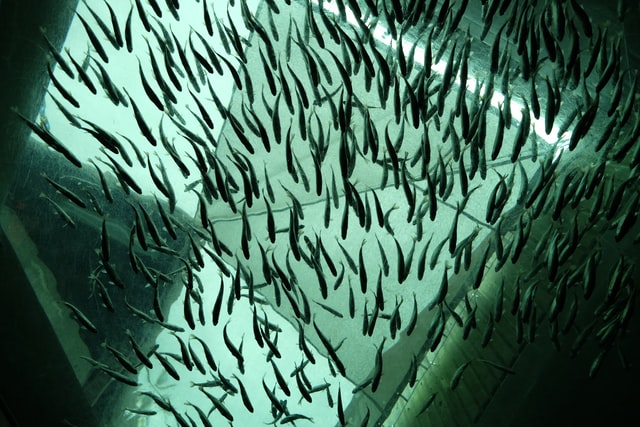

In April last year, the High Court of Australia affirmed the right of a West Tasmanian council to levy rates on the seabed within its municipal boundaries. This precedent means, in a legal sense, land is land, even underwater. It has implications for industrial...