Are you locked out of the housing market?

Do you want to see an end to market distorting subsidies to property investors?

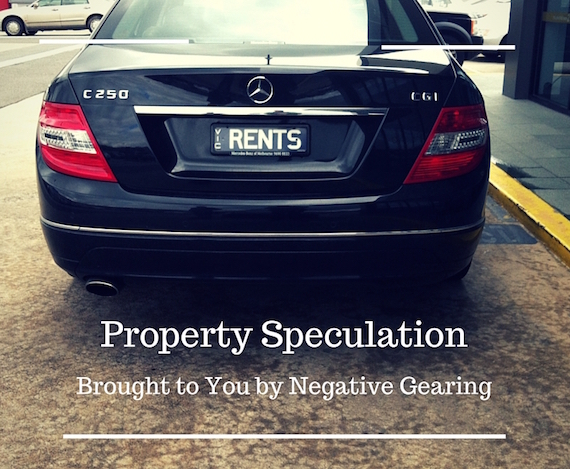

This petition calls for the Federal Government to reform negative gearing NOW! Negative Gearing must be limited to new housing only and in time should be removed entirely. It is time future generations had the same opportunities as others. This reform process must be the START of winding back the incredible advantages property investors have over someone trying to buy a home.

Property investors are playing with the lives of millions of people who simply want a home.

Look at these facts:

Income earners in the top 20% now own 73% of the value of all investment property (ABS 6523)

– 80% of Negative Gearing benefits those in the top 20% of occupations. (Grattan Institute)

– Australia’s land values increased $525 billion last financial year (ABS 5204.61) but governments struggle to find some $40+ billion per annum to fund schools and hospitals.

– Negative Gearing reform will not increase rents. (Saul Eslake) Linking it to new housing supply will increase supply, pushing rents down.

– 93% of Negative Gearing goes to benefit people over 30 i.e. older, wealthier property investors. (NATSEM)

– 94% of negative gearing investors buy existing housing instead of new construction, adding very little to supply. (RBA)

– Negative Gearing is a tax expenditure which costs the public some $12 billion per annum. No wonder the pressure is on to increase taxes!

This reform will save buyers decades in interest repayments. It is worth understanding and acting upon!

ACT now by signing, sharing and talking about this inequity.

Karl Fitzgerald

Prosper Australia

Totally agree. The corruption of the political world knows no boundaries. Its time to take the gloves off. Where do I go to sign?

i support a reform of negative gearing.

None of our western peers permit this filthy subsidy to the rich .

No wonder they call us a banana republic .

Look at these facts:

Income earners in the top 20% now own 73% of the value of all investment property (ABS 6523)

– 80% of Negative Gearing benefits those in the top 20% of occupations. (Grattan Institute)

– Australia’s land values increased $525 billion last financial year (ABS 5204.61) but governments struggle to find some $40+ billion per annum to fund schools and hospitals.

– Negative Gearing reform will not increase rents. (Saul Eslake) Linking it to new housing supply will increase supply, pushing rents down.

– 93% of Negative Gearing goes to benefit people over 30 i.e. older, wealthier property investors. (NATSEM)

– 94% of negative gearing investors buy existing housing instead of new construction, adding very little to supply. (RBA)

– Negative Gearing is a tax expenditure which costs the public some $12 billion per annum. No wonder the pressure is on to increase taxes!

Negative gearing is purely of benefit to the wealthy! Our local federal MP has, I understand, in excess of a dozen negatively geared properties. His wife may indeed have more in her own name! Only Australia and New Zealand of our peer countries allow negative gearing! If it’s such a fair concession which is to the overall advantage of society, why dont more of our peer nations adopt this concession? Answer, because it’s a tax avoidance rort! The pollies want to keep it to protect their own interests and those of their mates!

Negative gearing as it has been is merely a method for the rich to get richer. The theory is fine, but it should be limited to the first home. Otherwise it results in enormous class destinction, which of course is it’s purpose.

There is no way known that negative gearing as practiced in Australia and New Zealand is of any benefit to anyone who believes in social justice. It is simply a massive rort kept in place by the wealthy who benefit from a huge tax benefit, along with all the politicians who use the negative gearing strategy to benefit them selves, the big financial donors to all sides of politics and the international banking cartel, in league with the “Big Four” (too big to fail banks) who control the Australian financial markets. If the Australian governments at Federal, State and Local levels want to have REAL tax reforms, the first step should be to CANCEL negative gearing and at the same time introduce tax deductions for the interest being paid by any person wishing to buy a home of their own for themselves and their family in which they want to reside permanently. Once this has been implemented, a real tax reform agenda can be drafted to then start recovering a levy from the unimproved land value of each parcel of land in Australia (some would call this a Land Tax on the unimproved land value) commensurate with its locational value. At present there is a very small levy that local authorities call “rates” on the land, paid by the owner who hold title to the particular parcel of land. These “land rates” are usually only a very small amount of what it costs that local authority to provide and maintain all the services it provides for the communities. In other words, levy a tax based on unimproved land value that can encourage the use of sites that are being kept as “land banks” by organisations who currently pay a pittance as they force housing developments further and further away from the major centres of activity in every city, town or village in Australia.