Our latest Research

Rent-Controlled Resources: Why are we under-charging Australia's mining tenants?

This report examines Australia’s resource royalties and the gains to be made by moving to a more flexible royalty model with variable rates

Speculative Vacancies 2025 data update

Our latest Speculative Vacancies data update reveals the extent of unoccupied housing in Melbourne.

Buying better income taxes with land taxes

Tax reform is more than changing income tax rates, it’s about shifting taxes off income altogether. This report explores one of the most recommended reforms.

Staged Releases: Peering Behind the Land Supply Curtain

In this report we ask whether the private choices of property owners to supply new housing according to market conditions works against the stated public policy outcome of supply-driven affordability through rezoning.

OUR LATEST NEWS

Submission to the Inquiry into Local Government Funding and Fiscal Sustainability

Prosper Australia submission to Inquiry into Local Government Funding and Fiscal Sustainability (House of Representatives Standing Committee on Regional Development, Infrastructure and Transport) – 19 November 2025 Introduction Prosper Australia welcomes the...

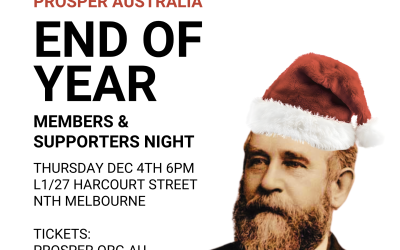

EVENT: Prosper Australia End of Year members & supporters night

Welcome to our end of year members & supporters night! Join us for a night of celebration and appreciation at Level 1, 64 Harcourt Street, North Melbourne. Hear directly from the Prosper team about the activities we have been up to this year and our plans for the...

Victoria’s infrastructure plan praised for tax reform, criticised for ignoring value capture

Prosper Australia today welcomed the inclusion of a stamp duty to land tax transition in Infrastructure Victoria’s new strategy but criticised the absence of value capture as a sustainable and equitable funding mechanism. “We applaud Infrastructure Victoria’s...