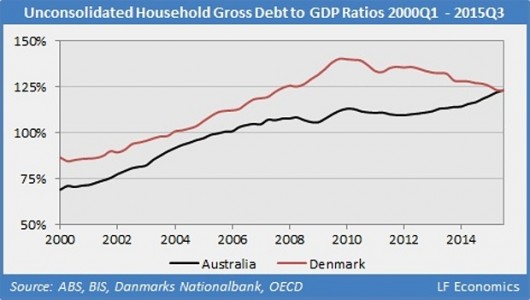

Last week, Philip Soos announced Australia had achieved global leadership in an exciting new arena:

According to LF Economics, we seized this dubious crown from the Danes in the last quarter. Denmark has been grinding away, painfully repaying principal for the last six years – the rubble from their housing bubble and bust.

A country’s total debt comprises borrowing by individuals, business and government. This table looks at just the private household debt burden – around $2 trillion, almost entirely to mortgages.

Did we buy nice stuff?

We traded each other second-hand parcels of land, inflated by debt, privileged by a dud tax system, restricted by dumb planning and cheer-led by the FIRE sector.

The inflation has been solely to land prices. The cost of construction hasn’t budged in real terms in 20 years.

Until the late 1990’s, residential land costs were a year’s GDP. The inflation of prices in the property bubble accrued entirely to land, now 230% of GDP.

Own-goals like this are why Australia is called, with full irony, ‘The Clever Country’.

Australia’s business debt reflects deliberate, informed decisions by hardened managers. In contrast, the biggest single influence on consumer mortgage appetite is probably the television program The Block.

That towering debt, exuberantly taken out in euphoria, will have to be repaid in full, on time, whatever the future exchange rate, economic settings or personal circumstances.

What was Denmarks peak? 140%. Still a lot more room to leverage. Have been waiting since 2010 for house prices to moderate. So many vested interests especially in our property investing government that the dumb money is bailed out each and every time. This could go one for decades by which time it will be too late for me and my family to have our own place. Meanwhile 2015 was the hottest year on record and humanity ambles mindlessly as a species to climate catastrophe and extinction.