Australia’s most high profile business reporter, Alan Kohler, turned up unannounced this week to find out about the group behind the rising interest in Henry George and Land Value Tax. Cross-posted from Business Spectator ($):

Almost 120 years after his death, Henry George may finally be coming into his own.

In the 19th century he was an economic rockstar. His book Progress and Poverty caused a sensation, proposing a single tax on land to replace all other taxes, and he picked up near devotion from geniuses like Albert Einstein, Leo Tolstoy and, in Australia, Walter Burley Griffin, among many others.

Essentially George led a revolt against rich landlords and property speculators, but he wasn’t a socialist. In fact he locked horns with Karl Marx, predicting, correctly, that if Marx’s ideas were tried they would result in dictatorship. Apparently the game of Monopoly was even invented in 1890 by a disciple of Henry George to demonstrate the evils of “land-grabbing” and property speculation. (It didn’t work: it turns out everyone loves being a ruthless landlord.)

Land tax and the related resource rent taxes, as well as the old hatred of landlords (called property investors these days) are making a comeback in Australia because of the twin problems of increasingly expensive housing and inadequate, inefficient taxes leading to gaping budget deficits.

One of the core recommendations in the aptly, but coincidentally, named 2010 Henry Tax Review (after then Treasury Secretary Ken Henry) was a proposal to replace stamp duties with a broad Henry George-style land tax.

Last week South Australia became the first state government to begin the process of abolishing stamp duties on property, with the eventual aim of replacing it with land tax.

And this week a submission from a Henry George devotee to the new Parliamentary inquiry into home ownership, recommending land tax as a solution to the housing bubble, got a blaze of publicity for 24 hours by declaring that we are in a property bubble and headed for a “bloodbath”.

As a young journalist in the early 1970s I often used to walk past a door between two restaurants in Hardware Lane, Melbourne, mysteriously labelled ‘The Henry George League’. I thought it might have had something to do with Sherlock Holmes.

One day, intrigued, I went in. It was a bit like a musty Christian Science reading room: a shrine to someone named Henry George, whose neatly bearded, avuncular face adorned the walls, and with a rather less neatly bearded elderly gentleman sitting behind a desk.

He helpfully gave me some pamphlets. As I walked away down Hardware Lane reading them, I understood: “Oh right, they’re just tax nuts.”

A single tax on land to replace all other taxes? That’s never going to fly. So I forgot about them for 42 years.

This week I visited them again.

These days the Henry George League is called Prosper Australia. They sold the building in Hardware Lane in 2007 and now occupy a desk or two in an office-sharing place in Richmond called LSX (“Creative Co-Working, Events & Cafe Space — Rethinking work and urban living”).

It’s run by an engaging, 40-something bloke named Karl Fitzgerald, who looks uncannily like Henry George and, no doubt just as his hero would have done, he bent my ear non-stop for an hour on the problem of rentiers and the myth of the land shortage.

Fitzgerald is the only full time employee of Prosper and there are two part-timers, as well as a group of believers who contribute research — academics like Philip Soos, who was one of the two authors of the sensational Parliamentary submission that got such a splash on Tuesday.

And that’s how I found my way back to the Henry George League … er sorry, Prosper Australia … trying to chasing down who its authors are.

The document was entitled “The Great Australian Household Debt Trap – Why Housing Prices Have Increased” and was lodged by something called LF Economics. The co-authors are Lindsay David and Philip Soos, a lecturer at Deakin University and, it turns out, a sometime researcher for Prosper Australia.

Lindsay David returned to Australia 18 months ago after completing an MBA at the IMD Business School in Lausanne Switzerland, in which his thesis was focused on Rio Tinto, and “a few weeks ago” he set up a website called LF Economics to sell his research for $19 a pop.

Last year he self-published a book called Australia: Boom to Bust, and this year he produced another book called Print: The Central Bankers Bubble, in which he declared: “the world is about to face another crisis that may make the GFC look like a walk in the park”.

The timing of their submission was perfect. The idea that we’re in a housing bubble was given decisive credibility a few weeks ago by Secretary to the Treasury, John Fraser, when he became the first senior official to use the ‘B’ word. Soon after that Reserve Bank Governor Glenn Stevens said he thought what was happening in some parts of the housing market was “crazy”.

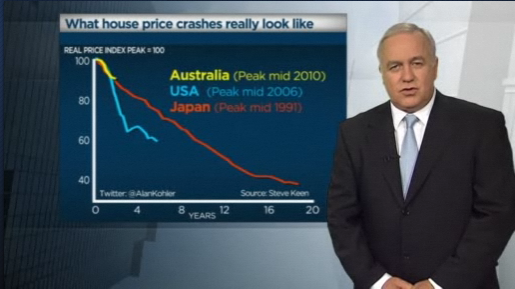

The umpires had spoken and the Great Bubble Debate had been won. This week’s stories quoting Lindsay David and Philip Soos that there is a bloodbath coming simply drove the point home — a sort of victory lap of the bubbleists.

The first recommendation in the LF Economics submission was straight from Henry George: for a land tax “to moderate both land price bubbles and their devastating busts”.

They point out that land tax is already in the toolkits of state governments, but has been “rendered comatose by a host of exemptions and concessional treatments”.

Essentially, they recommend that state land tax be extended to owner-occupied housing and agricultural land and calculated on a per square metre basis.

“On the other hand, the federal government could take charge by imposing a comprehensive land value tax on all land. An increasing marginal rate schedule taxes the least valuable land at 0 per cent, with rising rates calculated on a per-square-metre value basis. Land taxes apply per land holding, but not on an entity’s total holdings, to encourage development.”

There were 37 other recommendations, but of course these were not the focus on the huge publicity the submission got this week. Nor was that first recommendation on land tax. It was all about these two paragraphs: “A bloodbath in the housing market, however, appears a near certainty due to the magnitude of falls required for housing prices to again reflect economic fundamentals.”

“The largest residential land market bubble on record is truly incomparable and dwarfs earlier speculative episodes in the commercial and industrial land market.”

Lindsay David and Philip Soos may be right about that “near certainty”, or they may be wrong. In general it’s much safer to predict disaster than to predict happy days because you can never really be proved wrong: the disaster is always just around the corner, even if it takes longer than you said. If you predict happy days and disaster happens, you are undeniably wrong.

But they are on solid ground and in very good company complaining about land speculation, money printing, too much debt and general financial excess, although their language was clearly over the top — ‘hysterical’, as a few people said.

And the idea of extending land taxes does seem to be gaining traction, although not for the reasons proposed by either of the two Henrys, Ken or George. These days it’s about capping the housing bubble rather than replacing inefficient stamp duties (Ken Henry) or ending poverty and inequality (Henry George).

And the demands on governments to fund welfare, health, disability and infrastructure are now such that if land tax is extended to owner-occupiers, it’s more likely to be yet another additional tax — not the Georgian dream of a single tax.

That, as I concluded 42 years ago, will never happen.

Trackbacks/Pingbacks