Updated April 2016

- Location, location is a crucial real estate strategy but ignored in neo-classical economics. This leads to poor economic policy that ignores the natural advantage of owning a prime location over running a business.

- Investors hover around 50+% of all housing loans, up from 12% in the 80’s, and 19% in 1993. This reflects the crowding out of First Home Buyers. With investors feeding off each other, this pushes prices higher, faster, delivering more profits.

- First Home Buyers borrowed $80K on average in 1993. In 2013 it was $292,000. Just 2 years later it is up to $339,000 nationwide. The latest figures find FHB’s borrowing $403,000 in Sydney and $355,000 in Melbourne. This requires First Home Buyers to save up larger deposits ($60K minimum). This is incredibly difficult with the limited wage growth prevalent. High prices act as a barrier to entry for home buyers, reducing competition for investors.

- The wealthiest 20% own 72% of the value of investment properties. This value can be leveraged for further investment.

- Self Managed Super Funds – residential & commercial investment is now *capital gains tax free* for those in their pension phase (55+).

- Self Managed Super Funds – there is only a 10% capital gains tax for properties held for 12+ months. SMSF’s flipping property in under 12 months pay just 15%.

- Self Managed Super Funds – it’s now legal to borrow within the super entity!

- 60% of investor loans are interest only loans – facilitating speculation upon rising prices. This means they only have to repay the interest, not the principal, favoring short term speculation where rents charged cover the interest.

- The recent ability to attain 40 year mortgages in Australia allows greater purchasing power for FHB’s, pushing prices and thus investor profits ever higher.

- Housing vacancy rates don’t include those held empty by speculators. This facilitates the ‘housing supply/ land supply shortage’ scare campaign. Our Speculative Vacancy reports find vacancy numbers at three times the REIV’s figures, promoting a false sense of scarcity (80,000 empty homes) → higher rents.

- Land Tax is barely $400 on a $330,000 block. Most don’t pay because their land holdings are under the $250,000 Land Tax threshold – thus the larger number of vacancies in the poorer west of Melbourne. This ensures there is little in repayment to the people for the public services delivered to an investor’s tightly held location, location. A low Land Tax enables high land prices. Land Tax functions as a counterweight to mortgage debt.

- Land Tax thresholds: Over the last decade in Victoria, Land Tax thresholds (the value at which Land Taxes kick in) has increased from $85,000 (2001) to now $250,000. This sees a once affordable piece of land, now valued at $330,000, pay barely $400 in Land Tax. This encourages land speculation, delivering low risk, high profit returns for investors. The raising of thresholds is a national trend, virtually wiping Land Tax out as an affordability tool.

- Housing tax exemptions are a $30 billion black hole in the budget. Treasury estimates these will cost $454 billion for 2015-2024. This forces government to increase taxes on productive activity. Land speculators pay little back, whilst workers are penalised for productive efforts, reducing their savings and thus their ability to enter the housing market.

- 1.1 million investors have claimed $33.5bn in Negative Gearing deductions (1993 – 2011). Negative Gearing encourages higher bidding as they know they will be rewarded by government with a tax discount.

- Only 8% of Negative Gearing loans are invested in new supply → crowding out FHO’s.

- Stamp Duty hits the poor hardest – 15% of such revenues come from supposedly affordable housing areas (on the sprawl) versus only 4% if we used Land Tax instead.

- Stamp Duty impedes the transfer of property and thus the ability to move closer to work. This soaks up more time and energy in the commute, along with the accompanying petrol bill, further sapping savings. The upward mobility of home owners is challenged.

- Land is fixed in supply. No matter how much investment, it will only push prices up. This is overlooked by most analysts but well understood by experienced investors. Thus the support for immigration, for more investment.

- “Your taxes fund the infrastructure that makes investors’ land more valuable. Cheers”

- Land accounts for 70% of a property’s value, but yet we call it a housing bubble. This is another tangent diverting attention from the core housing cost – land and its’ locational value.

- Council rates set on Capital Improved Valuations (CIV) or NAV see the family home paying 30% more than a neighbouring land banker (rates are set on the improvements, the house). Perverse incentives – why are we charged higher CIV rates for improving our homes, for installing solar?

- The spread of rate-capping amongst the states further reduces the taxation of economic rents. This enables more rent to be capitalised into higher and higher prices. For government, revenue pressures lead to increased fixed costs such as garbage fees – a regressive tax hurting those on lower incomes trying to save. A myriad of issues are compounded by this populist move.

- Foreign investors’ ability to buy real estate has not led to lower prices. This is partly due to hoarding incentives, but mainly because no matter how much foreign investment, you can’t create more land. With rents barely one third of capital gains, it is more profitable to leave properties empty.

But wait, there’s more:

- Postcode hopping: property spruikers are quick to advise on the ability to move your electoral address and one other bill (ie mobile phone) to your investment property. One can then claim this as the primary residence and avoid paying capital gains tax, enabling the property to be sold in the 13th month (the time limit for home owners before re-selling).

- Property options – ‘no money down’, just surf around on google earth and a few council websites, fill out a bit of paperwork and make $15,000 in 5 hours or $7.5m shuffling papers over a few years to benefit from rezoning. Listen to the Renegade Economists dissect the topic.

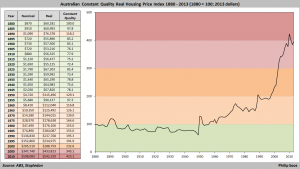

- The 50% Capital Gains Discount- the 1999 GST payoff the Howard government gave to the property industry in return for their muted criticism of GST on building inputs. This has been the single most damaging policy loophole for genuine home buyers. Almost like clockwork, the 1999 discount launched the current property bubble as one can see from this graph. Click to enlarge. We remind that a well implemented Land Tax is more effective than a CGT.

I never knew how corrupt institutional government is. This is what they are doing with our taxes? Honestly I cannot wait for the full force of the coming and unavoidable economic crisis as maybe then common sense will prevail when it comes to managing our taxes in a consructive rather than wasteful manner.