The move towards Land Tax reform continues with two supportive papers out in the last few days.

Launch Housing has a proposal to fund domestic violence programs out of a vacant housing tax. This was inspired by recommendations from the Royal Commission into Domestic Violence. They build a case for this urgent need by referencing:

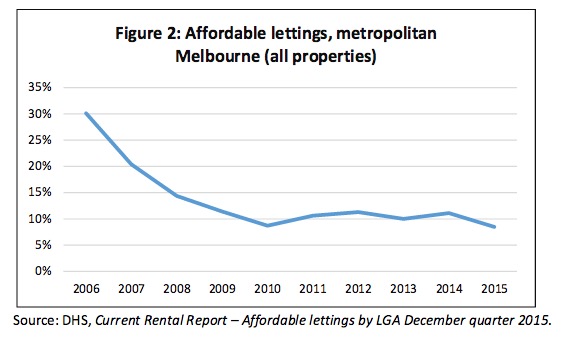

In 2006, 30.1% of all rental properties were affordable. By 2015, this figure had fallen to just 8.5% of all rental properties. (see graph above)

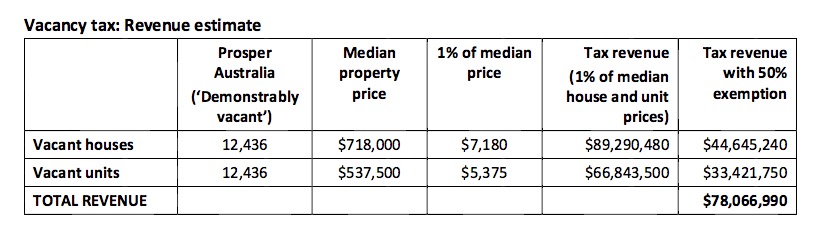

Launch also refer to our Speculative Vacancies report and advocate that a 1% tax on median priced housing could fund the domestic violence programs needed. Their preferred model to raise the $78 million objective is:

Readers will immediately spot a problem. A tax on vacant housing makes no distinction between the land and housing. A tax on housing will have unintended effects. Under such a proposal, land bankers will pay less than an investor who could potentially rent out an ageing home. For those old weatherboard homes that once were the bedrock of affordable rentals, further taxation will motivate the demolition of what could be a loveable home. The site then sits idle until sufficient capital gains have been delivered. This reduced supply will offset much of the downward pressure on rents the housing tax is meant to generate.

Readers will immediately spot a problem. A tax on vacant housing makes no distinction between the land and housing. A tax on housing will have unintended effects. Under such a proposal, land bankers will pay less than an investor who could potentially rent out an ageing home. For those old weatherboard homes that once were the bedrock of affordable rentals, further taxation will motivate the demolition of what could be a loveable home. The site then sits idle until sufficient capital gains have been delivered. This reduced supply will offset much of the downward pressure on rents the housing tax is meant to generate.

Council Rating in Victoria (and most states) already penalises homeowners for adding solar panels or renovating their home. Homeowners typically pay anywhere from 8 to 30% more in rates under Capital Improved Valuation (or NAV). Property speculators sit on vacant land because the uplift in land values far outweighs payments under either council rates or a ‘vacant housing tax’. Such land owners are subsidised by active homeowners.

If Launch Housing wants a mere $78 million for domestic violence funding, a simpler reform of housing taxation would be to take one step backward, before we go two steps forward. The Napthine government implemented policy failure 101 when it announced the First Home Buyer Stamp Duty discount in 2013. This cost the Victorian budget $70 million in 2013 – 14. That figure has since increased. Lower stamp duty payments have not saved buyers a cent. Victorian First Home mortgages have increased by $63,100 since July 2013 to the staggering January 2016 total of $355,000. Supposed Stamp Duty savings have seen similar or higher market prices, inferring that banks have been the main beneficiaries of the Napthine reform. The amount that was paid in stamp duties to government is now paid in higher mortgages to banks. The added interest cost over the lifetime of the mortgage means that housing is actually more unaffordable, adding to household pressures.

The second problem with the vacant housing tax is the difficulty of deducing whether a home is vacant or not.

A more refined reform measure was advocated by ACOSS, who have this week released a policy briefing paper in support of a broader Land Tax system. This reform puts both property speculators and homeowners on a level footing. As discussed, homeowners are already penalised more than land bankers. Land Taxes are barely $500 on an average site in Melbourne. ACOSS wisely states that the Federal government should make up any revenue shortfall in the transition away from Stamp Duties and towards Land Taxes.

John Freebairn raised a key point in the AFR:

“A comprehensive land tax using the current municipal rate base would have a deadweight cost of zero,” he said.

“So it would be throwing away something that costs you 80¢ [stamp duties] for something that costs you next to nothing. That’s about the best productivity increase we have sitting anywhere in Australia.”

Stamp Duties raise $13 billion nationally, which if replaced with a Land Tax could add $10.4 billion to GDP through the removal of the deadweight costs Freeborn states. Prime Minister Turnbull could help break the logjam by not only funding transitional revenue shortfalls, but using some of the looming growth dividend of $10.4 billion annually to fund a Land Tax public education campaign.

Prosper Australia continually wins the economic argument. The challenge is for the public to garner how significantly the long-term benefits outweigh the short-term costs. Then we can win the political economy challenge. For this to happen the public must understand:

- how a Land Tax channels the land bubble away from banks and towards giving all citizens a tax cut

- how Land Tax works to penalise vacant land and vacant housing

- why under the current system land price takes all the gains

- why more and more respected economists, such as Michael Pascoe, support this transition

- how such a system cannot be gamed to Panama and beyond

- what it will do for inter-generational inequity

- and lastly, how we will all be better off with a significant growth dividend

The speed of discussion on the need for Land Tax reform is again encouraging. With Victorian land values increasing $133.7 billion last year and national land values increasing a staggering $525 billion, it is no wonder more are looking at this natural revenue source as a funding base. We prompt those interested in why we and other economists are so passionate about a simple tax to delve deeper:

Land tax commentary

Land Value Tax – solving the efficient tax problem

The Total Resource Rents of Australia – the big picture

Support our work by becoming a member or donating to our tax-deductible entity, the Prosper Australia Research Institute.