The economic impact of stamp duty, a study by Deloitte Access Economics for the Property Council of Australia released yesterday, finds Australia’s GDP would increase by $3.3 billion and real consumption by $9.7 billion if conveyancing stamp duty was replaced by an increase in the GST.

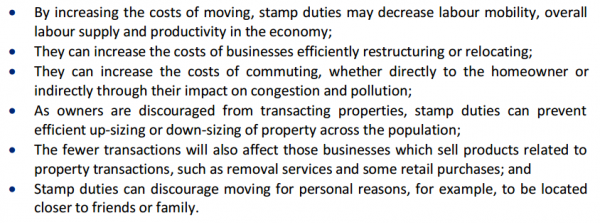

Deloittes explains the damage and misallocation stamp duties impose:

Quite right. Stamp duty is a very bad tax with particularly high economic costs. Let us strike it out.

The PCA wants to make up the revenue shortfall with an increase in the GST, switching taxes from property to consumption. Making Deloittes examine only this exchange is… naughty.

Here is Deloittes’ hint of better things:

What if we considered taxing the consumption of property, which Deloittes alludes to – exchanging stamp duties for land tax, along the lines of recent Treasury estimates and the Treasury’s Australia’s Future Tax System recommendations?

The marginal excess burden of stamp duty is about 70c. Every dollar raised costs taxpayers $1.70. Ouch. We need to rid ourselves of this curse.

The MEB of GST is 20c and costs $1.20. Better.

But look at the end of the table. The MEB of land tax is negative 10c, so a dollar raised cost 90c. Here is a tax that actually costs Australians less than provides to government.

Why on earth would anyone promote half-hearted reforms when there is a tax available with this extraordinary feature? We make a profit!

The PCA exists to advance its members – property owners – who the suggested tax swap is certain to advantage. The national interest can go hang.

But here, hidden in clear view, is a better answer. If only the PCA had commissioned Deloittes to calculate that exchange.

Looks like MEB = Marginal Excess Burden. Courtesy demands that we define acronyms. And the link : Australia’s Future Tax System is to a site not directly to the data. The reader is left to search. The phrase “But look at the end of the table” goes nowhere: which table? Where will I find it? The writer should execise a little more discipline and hasten slowly. Remember most of us are not as expert as he is.