Hot on the heels of Prime Minister, Tony Abbott’s gutless announcement that he won’t reform negative gearing, prime spokesman for the property industry, the Property Council of Australia (PCA), has released the following statement:

Executive Director, Nick Proud, said providing certainty on the future of this tax measure will benefit housing affordability and give average workers who invest in property confidence.

“The data is conclusive – negative gearing in Australia is primarily used by average workers who in the majority, own only one investment property,” Mr Proud said.

“It is great to see the Federal Government providing certainty for the hundreds of thousands of average workers whose modest investments are contributing to housing supply and rental affordability.

“There is no evidence to suggest that negative gearing drives up house prices – the opposite is true…

“With an ageing population we need to look at ways of taking pressure off the budget and negative gearing is one way for average workers to save for their retirement.

“It also helps encourage young Australians and first homeowners to take their first step into the property market by providing what can be a more economical option – purchasing initially as an investment rather than as an owner occupier.

Wow. The PCA makes Joseph Goebbels look like an amateur, since you couldn’t spin more propaganda into a few hundred words. Let’s address each of the PCA’s claims one-by-one.

First, that negative gearing “improves housing affordability” and that “there is no evidence to suggest that negative gearing drives up house prices – the opposite is true”.

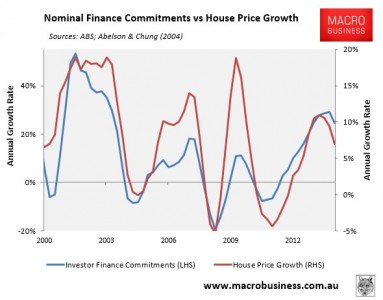

Below is a chart tracking investor finance commitments against house price growth:

That’s a pretty damn strong correlation, suggesting that if you remove excess investor demand, via unwinding negative gearing, then house price growth would be dampened, making homes more affordable. No ifs, buts or maybes.

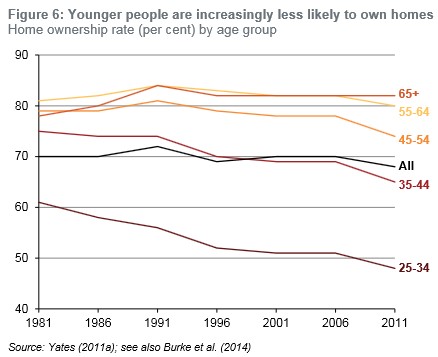

In turn, this would benefit first home buyers, who have been shut-out by the investor orgy:

And with lower house prices, younger Australians would not need to devote as much of their lifetime’s earnings to pay-off a home.

Home ownership rates, which have collapsed, would also be higher, particularly amongst younger cohorts:

In turn, the PCA’s claim that negative gearing “helps encourage young Australians and first homeowners to take their first step into the property market by providing what can be a more economical option – purchasing initially as an investment rather than as an owner occupier” would be null and void, since first home buyers would be able to afford to purchase as owner-occupiers.

What about the PCA’s claim that negative gearing is the purview of the “average worker” rather then the wealthy? Again, I call bullshit.

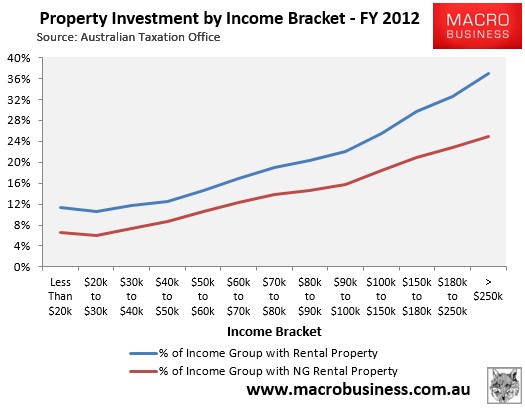

The Australian Tax Office (ATO) data that it has relied upon for this claim does show that the majority of rental properties are held by middle income earners:

However, it also shows that property investment is most popular amongst higher income earners, presumably due to the increased tax benefits on offer as one moves up the marginal tax scale.

In 2011-12, 35% of taxpayers earning over $180,000 held an investment property, with 24% negatively geared. By comparison, 15% of taxpayers earning between $50,000 and $60,000 held an investment property in 2011-12, with 11% negatively geared (see next chart).

Average net rental losses are also much higher in dollar terms (but less in percentage terms) for higher income earners:

However, there are also major issues with the ATO Tax Statistics data that significantly reduces its reliability and discredits the PCA’s argument that negative gearing is a middle-class affair.

As explained by ABC’s Michael Janda last year, the ATO Tax Stats only look at “taxable income” – i.e. after people take out various deductions to lower their tax bills – hence the income figures PCA has quoted are significantly understated:

The very reason that many housing investors fall below the $80,000 threshold is because they have used negative gearing to slash their tax bill…

The vagaries of what is counted as income for tax purposes, and of tax deductibility, mean that it is impossible to be sure exactly how many landlords really earn less than $80,000 per year.

One other interesting fact from the ATO’s figures is that the average ‘total income’ of Australian taxpayers was $55,000.

That means that on the way the tax office calculates ‘total income’ – looking at net rent and net capital gains, and excluding non-taxable items – someone on $80,000 is already a relatively high income earner.

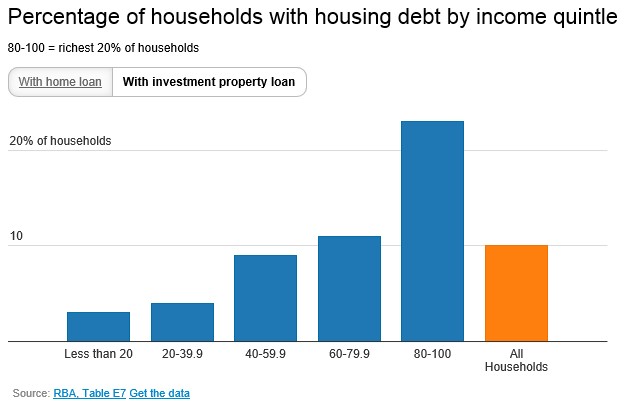

Moreover, the Household Income and Labour Dynamics in Australia (HILDA) survey shows that the wealthy hold most of the negatively geared investment homes, as explained by The Guardian’s Greg Jericho last month:

…The Reserve Bank uses data from the Household, Income and Labour Dynamics in Australia Survey. That survey found that in 2010 that the richest 20% of households were much more likely than other households to have an investment property loan:

…And since 2002 there has been a surge in investors within the richest 20%. In 2002 just 16% of the richest 20% of households had an investment loan, by 2010 it was up to 23%…

Then there is the PCA’s claim that negative gearing “contributing to housing supply and rental affordability”. Really? Because the last time I checked, investors have overwhelmingly purchased existing homes, so have not added to supply:

It follows, then, that if negative gearing was wound-back and a proportion of investment properties were sold, they would be purchased by renters (or other investors that would rent them out). In turn, those renters would be turned into owner-occupiers, reducing the demand for rental properties and leaving the rental supply-demand balance unchanged.

As a result, rents would be unaffected, as was the case when negative gearing was last abolished between 1985 and 1987 (shown in red):

Finally, what about the PCA’s claim that “with an ageing population we need to look at ways of taking pressure off the budget and negative gearing is one way for average workers to save for their retirement”.

Surely the best way to ensure people’s security in retirement is to lower the cost of shelter and increase access to first home buyers? Australians would be in a far stronger financial position, and would be far better placed to save for their own retirement (and avoid the aged pension), if they were not required to pay-off some of the world’s biggest mortgages, thanks to policies like negative gearing.

On every count, the PCA’s claims are false and represent nothing more than rentier propaganda.

unconventionaleconomist@hotmail.com

Reposetd with kind permission from macrobusiness.com.au