https://unsplash.com/logantroxell

Following the recent Treasury submission to the Federal government’s Tax White Paper, which highlighted the positive marginal excess burden of Land Tax, is a more detailed analytical paper from Treasury using extensive modelling to report on the incidence and efficiency of major taxes in Australia. The report states:

Our estimates of the additional welfare cost of a marginal tax change (that is, the marginal excess burden) of major Australian taxes largely align with estimates reported in earlier Australian studies. Consistent with earlier studies, stamp duty on conveyances and the company income tax are the least efficient taxes (that is, they have relatively high marginal excess burdens), while the most efficient tax is a hypothetical broad‑based land tax. We test the sensitivity of the ranking of the efficiency of major Australian taxes to a range of assumptions about economic agents and the structure of the Australian economy and find that the relative marginal excess burden of major Australian taxes is robust to a wide range of model parameters.

Detail on the incidence and efficiency of Land Tax is provided in Chapter 6.

6. BROAD-BASED LAND TAX

Land tax is modelled as a hypothetical broad-based land tax similar to municipal rates.Theory and assumptions

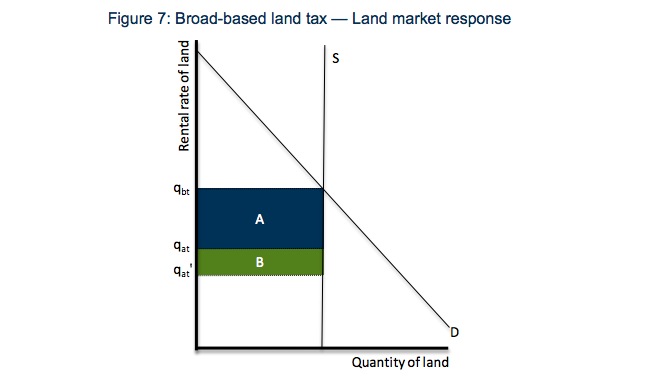

Figure 7 describes the land market. The total amount of each type of land (residential and non-residential) is assumed to be in fixed supply. Land users pay the before-tax rental rate given by the intersection of demand and supply at Qbt. Prior to the tax change, land-owners receive the after tax rental rate of Qat. This implies tax revenue equal to A. This figure shows that an increase in the land tax is completely borne by the land-owners. The after-tax rental rate falls to qat’ and the land tax revenue increases by B.In a closed economy model in which the tax revenue is returned as a lump-sum transfer, this would imply no change to the economy. However, taxing land in an open economy with foreign ownership will have aggregate welfare impacts. Since the revenue collected from foreign and domestic land owners is only redistributed to the domestic household, an increase in land tax results in a net transfer to the domestic household. The domestic household will receive a net windfall gain from the lump-sum transfer that exceeds its tax expense. This increase in income is expected to result in both increased consumption and increased leisure.

Results

We analyse the marginal excess burden and incidence of the broad-based land tax by uniformly increasing the rate on both residential and non-residential land by an amount sufficient to raise one dollar of revenue from all taxes.

Activity

As suggested by the theory broad-based land tax has a very slight impact on factor income as seen in Chart 25.

The foreign ownership of land means that increasing broad-based land tax results in a small income transfer to domestic residents, which is reflected by a small increase in consumption (Chart 26).

The small increase in consumption is largely offset by a decline in net exports, with a negligible effect on GDP.

A change in broad-based land tax causes few distortions in the economy and therefore implies little change to revenues from other tax heads. Broad-based land tax is, however, a tax deduction for firms and households which requires around 1.15 dollars of revenue to be raised from the broad-based land tax to achieve a net revenue increase of one dollar (Chart 27).

Marginal excess burden and incidence

The net transfer of income between foreign and domestic households raises welfare (Chart 28). As detailed above, the total foreign ownership share of factor income from land is estimated to be around 10 per cent. Consistent with that, welfare improves by 10 cents per dollar of net revenue raised. In

other words, the broad-based land tax change implies a loss of income to the domestic household of 90 cents, while the lump-sum transfer increases their income by one dollar, which implies a net income gain of 10 cents.

Comparison with other studies

Table 5 reports the marginal excess burden based on the baseline calibration, along with the results of the sensitivity analysis (see Appendix A for details). The highest and lowest estimates from the sensitivity analysis are highlighted in red and green respectively. The baseline negative marginal excess burden reported here is driven by the assumption of foreign ownership of land. The lowest estimate is due to doubling the foreign ownership share which broadly doubles the benefit to Australians of taxing land. The highest estimate assumes there is no foreign ownership in Australia which implies broad-based land tax has a zero marginal excess burden.While the modelling reported here focuses on a broad-based tax on land, earlier economy-wide studies, such as the CGE analysis of the Current Australian Tax System report (KPMG, 2010) analysed land taxes and municipal rates separately. Both were found to be relatively efficient, with municipal rates being slightly more efficient due to its broader base. In a recent report for the Housing Industry Association, Independent Economics (2014) used a similar framework to this paper, which yielded an estimated a negative marginal excess burden for land-tax that is similar to the estimate reported here.

The 2011 NSW Financial Audit examined land tax, as currently legislated, and found it to have a marginal excess burden of 9 cents per dollar of net revenue (see New South Wales Treasury, 2011). They acknowledge that a well-designed land tax could achieve a zero excess burden, and attribute the higher distortionary impact of the real world tax to its narrow base. Land tax does not apply to the principal place of residence, which discourages the provision of rental accommodation. Further, the application of land tax to the aggregate holdings combined with a tax free threshold discourages investment by institutional investors, such as superannuation funds.

Consistent with our analysis they find the marginal excess burden of slightly lowering the tax free threshold to be negative 8 cents per dollar of net revenue.

The conclusion finds:

Our analysis suggests that capital taxation via the company income tax is largely borne by workers through lower labour productivity which causes lower after-tax real wages. In contrast, domestic capital owners benefit from higher after-tax real variable capital income (that is, from structures and equipment) which is largely offset by lower after-tax real rental income from fixed factors (that is, land).

This implies any taxes paid by capital are offset by the subtle subsidy of economic rents delivered by land.

One day an economic model will discuss the influence such negative behaviours have on the macroeconomy. It seems Treasury is suggesting the cost of company and income tax be offset via land speculation. But what of the damage to the wider economy? How do higher rents play into our export competitiveness, the proficiency of our productive sector and the resultant reducing in job opportunities? These are the questions economic modellers need to incorporate in future analysis.

Why no analysis of the allocational efficiency gains from an LVT?

Uncompensated (to the community) occupation of Land can be seen in three ways

a) pure monopoly rent

b) defacto State subsidy

c) negative externality

The distortionary affects of which are described here.

http://en.wikipedia.org/wiki/Deadweight_loss

If a valuable factor of production is misallocated, then GDP will shrink. So will net welfare.

Exactly. Well pointed out. We must push modellers to allow for this.