Schroders has a paper out on Australian real estate investment trusts (REITs) A wolf in REIT’s clothing that should have every RE executive checking the polish on their shoes. David Wanis is as dour as a parson, predicting a ~1.6% return for each of the next three years.

His assessment is based solely on the sustainable cash flows they produce, rather than any crashnik theory about a land price correction.

“As income producing assets, the value of a REIT is in the buildings not the land. Land and scarcity (often artificial due to planning laws) determine supply but the building determines the cash flows.”

Exactly.

Before the rentiers seized the economics curriculum, there were three factors of production: labour, capital and land (plus land-like instruments such as mineral deposits, radio spectrum and taxi licenses). Now, they pretend there are only two – labour and capital – a conceit that allowed the investor class to assume entitlement to all forms of economic rent. Oh, Happy Days!

“The second issue in the current environment relates to financing cost. Indeed there is not much else for REIT management to do but M&A and financial engineering.”

Wanis is saying all the skill and expertise REIT management brings to the job in letting, keeping buildings attractive and dazzling investor presentations accrue to them – a return to labour, not unit holders.

“Finally, although there is an assessment of sustainable cash flows on this basis it’s not possible to prevent the engineering from adding risk to the investment – and as time heals all wounds, REITs are gearing up again to take advantage of cheap debt to leverage distribution growth, justify M&A or a combination of both.”

“’Sophisticated’ investors smirk at the thought of the home buyer increasing their price range for a 25+ year financial obligation due to temporary declines in interest rates however the average Australian may look at those atop the commercial property ladder in this country and wonder if they are not doing pretty much the same thing.”

I am starting to like the cut of his jib. How refreshing.

“So when assessing the cash flows investors can expect from REITs they should look at the ungeared AFFO (Adjusted Free flow of Funds from Operations) for a true measure of asset returns – which currently show a yield of 5.1% against a distribution yield of 5.7% – and keep a watchful eye on management in levering the balance sheet to wonder if the risk of loss is once again creeping higher. As observed during the GFC, the impact degearing a REIT under stress has on total returns can be devastating for investors.

Thangeraj and Chan lay out the investor sacrifices of that era:

“The GFC eroded the peak market capitalisation of Australian REITs from AUD147 billion in 2007 to … AUD74 billion at the end of the 2010 financial year (ASX 2007; ASX 2011). The steep decline of asset values during the GFC was magnified by the high gearing employed by the A-REIT sector.

Investors in the REIT sector were badly burned in the GFC. Those in Centro et al were erased. This is a highly unattractive investment medium.

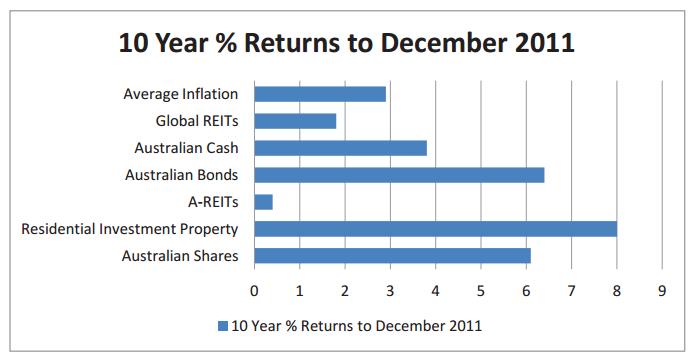

Source: ASX

Back to Wanis:

“Long term performance indicates that nominal ungeared sustainable cash flow growth rates have been anything from 0% (industrial) to 1% (office) to 5% (retail).

“Based upon historical growth rates nominal ungeared AFFO per share growth at around 1.5% per annum for the A-REIT universe is expected – and although there may be some argument about greater or lesser growth in the future, the economic realities of these assets means the range of outcomes is likely to be pretty narrow.

“Despite the underlying fundamental risks now being lower than seven years ago, the valuation risks facing investors as almost as extreme today as they were then. Recent performance can sometimes be a useful guide to future performance however often the sign is reversed – having outperformed Australian equities by 3.5% over the last three years and subsequently pushed valuations to levels not seen since just before the GFC our view would be the recent past has sown the seeds for a risky future.

Commercial RE is odd lumpy asset class and Wanis’ analysis highlights some of the risks. Yields are modest and growth elusive. Like residential investment at current market multiples, it begs the question: Why would you bother?