The new Andrews Government provides a fresh opportunity for reviewing the role of state revenues. The current property bubble has provided a windfall in Stamp Duty revenues allowing for considered reform.

The hot topics the State government must address to enhance its policy integrity include:

- the leasing arrangement for the Port of Melbourne

- the role of value capture in funding the removal of 50 level crossings

- the ineffective nature of Stamp Duty discounts for First Home Owners (FHOs)

- a willingness to maintain public ownership of the Vic Land Titles office.

- ensuring the revenue independence of local government

Our concern with the Port of Melbourne privatisation includes the leasing price to be paid. The proposed one-off sale is a poor outcome for taxpayers. The ALP government is keen to fall into line with the ‘asset recycling‘ agenda of the Federal government. A fairer system would be to lease out the Port at market rates, in seven year contracts. This is preferable to the 50+ year contract that has been mooted. Over time, as the value of the Port increases, the people of Victoria will also benefit from the value of the Port they built.

The Andrews Government was very savvy in announcing their Value Capture program. They plan to capture the value of the land ‘reclaimed’ by grade separation ie the land above a new train tunnel built under a road. This delivers a no-losers type approach to value capture. We would prefer the government was not as beholden to ratings agencies as they seem and instead could sell infrastructure bonds to the market place to raise the revenue needed for these separations (rather than the one-off sale of the Port). Value Capture on all surrounding properties would then re-pay bondholders over time. However, the politics of the ALP micro value capture policy could well build consensus once the people see how effective this mechanism is in providing a long-term revenue stream.

The ALP has in the past pushed for populist reforms such as Council Rates caps. This will undermine Council independence, leading to further centralisation and the inevitable ‘need’ for a higher GST.

The one area of reform the Napthine Government did well in was Taxi License reform. The ALP government must resist the temptations of vested interests to turn back the clock.

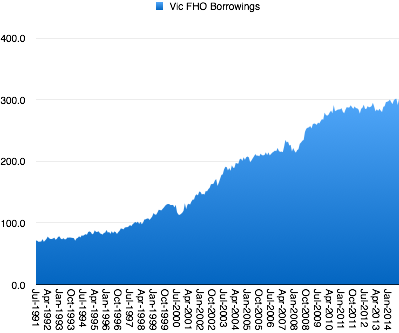

The new government should urgently review the effectiveness of Stamp Duty discounts for FHOs. This failed policy has resulted in a wealth transfer from the public purse to the finance industry. FHO’s are still competing in a market dominated by investors – instead of paying the SD amount to government (as poor a tax base as it is), a similar amount is paid to banks instead. The result is that FHO borrowings have continued to increase, standing at a near record $301,000 average loan size. (ABS 5609 Table 9b)

The outcome of Stamp Duty discounts was plain to see. The above graph shows how prices increased following the Napthine SD discount. A more effective reform would be to phase out Stamp Duty and replace it with a reformed Land Tax.

The size of FHO borrowings should have citizens concerned about at the endemic policy failure that is housing affordability. But yet it did not rate a mention in the State election. With our recent findings on vacant housing and our regular critiques of former Planning Minister Matthew Guy’s rampant re-zoning agenda, the Andrews Government must seriously investigate why housing (read land) prices are threatening Melbourne’s ‘Most Liveable City’ title.

Lastly, the final days of the Liberal Government saw the short sighted move to privatise the Victorian Land Titles office. This was set to raise barely $500m. Prosper Australia rasied concern about this challenge to the fundamental contract of government with the land owning public.

This follows a trend with attempts in the UK and also NSW to ‘heal’ fractured finances by privatising this vital government service. We find it ironic the conservative ‘solution’ to a tax system that ignores the land bubble is to push up the costs for researchers investigating the damaging effects of high land prices (and thus borrowings). This attempted privatisation of the data commons is a form of protection for vested interests and aims to further ‘hide the bubble’.

Land titles searches were always free in western economies. The creep began in the 70s with Victorian land titles searches increasing to $1 per title. Today they are at $4. With privatisation this cost will only go up. Many US jurisdictions have free online services to check property valuations, adding an important level of transparency. Some of our upcoming research projects will require title searches on thousands of properties.

One only has to compare the poor Victorian land channel to the geo-spatial capabilities of Queensland’s land data to see that more resources are needed in this area for indepth study.

Further detail on our policy requests can be seen here.

Use Land Value Capture to self-fund the rollout of decent public transport infrastructure, especially in the light of the massive savings arising from the cancellation of the East-West Tunnel.