We were warned of the dangers of the wealthy advising on future budgetary levers. But we thought more of the BCA’s Tony Shepherd than this shallow display for vested interests.

We were warned of the dangers of the wealthy advising on future budgetary levers. But we thought more of the BCA’s Tony Shepherd than this shallow display for vested interests.

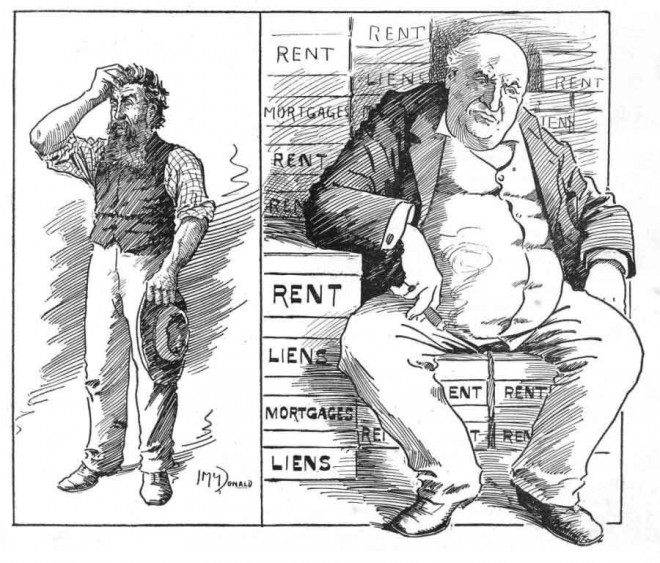

With great fanfare we are to maintain the Australian way of life with the burden placed on the productive sector, gleefully paying for the incredible rent-seeking evident in so many facets of the Australian economy. The Commission of Audit (CoA) ignores the principal pressure point widening the wealth gap, a gap that is threatening the health of so many democratic nations. That reality gap is defined by the unearned incomes, the windfall gains derived from government granted licenses in land and natural monopolies.

Instead the CoA ignored this, preferring to prepare the ground for privatisation. The global failure of the public finance system has opened the door to rampant privatisation throughout Europe and in many parts of America. The interests of the 1% are reinforced by austerity policies which go against the grain of economic history. This drains rather than pump-primes the economy, putting firesale pressures on privatisation prices.

The commission’s terms of reference were to look at expenditure only, but where it suited they made recommendations furthering the IPA led wish-list. This conveniently excused the pressures enforced by tax minimisation (a.k.a. legalised corruption) that our public finance system encourages. It also set the scene to overlook the problems the very tax system encourages. Is it not possible to raise revenue and encourage good behaviour? Rather than looking at the incredible advantage one has from owning a piece of the earth (or a privatised monopoly), we’re told that a married pensioner is expected to lose $289 per week upon these recommendations. Our prime minister receives $10,344 a week, one of the highest paid leaders in the world.

Meanwhile in the background smirking are the likes of Gina Rinehart, earning $276 million per week in unearned income. She still has not delivered one tonne of iron ore to the market. She is a glorified landlord, carving off her mineral rights for multibillion-dollar sums. Rhinehart did not provide any productive prowess to create the minerals, nor their naturally rising price. That is a legal privilege to unearned income. No small business person has that opportunity. Such advantage should have guided the CoA’s findings. However, the 60 recommendations are a platter of handouts for rent seekers – those seeking to earn ‘money in their sleep’.

The CoA uses coded language to etch closer to mass privatisations. Their solution to budget pressures is instead of taxing a small proportion of natural monopolies, to instead sell the last remaining crown jewels to those same monopolists.

Recommendation 58: Management of the Commonwealth Estates. The clarion call is for a central registry of Commonwealth properties to be held within the Department of Finance, with ‘greater private sector experience in property management’ a wink to sell off these assets. Only those who can access and pay at the highest price are entitled to these spoils, spoils that past generations have paid and cared for, their rates building the infrastructure that is now so scarce. With so much land currently bought by foreign interests, concerns are enhanced.

Recommendation 57 calls for privatisation of the Snowy Hydro, Aussie Post and interestingly the goldmine – Defence Housing Australia (amongst others). With $2.1bn in assets under management, it owns many central locations developers are eagerly eyeing off. The NBN is also tipped to be privatised. As classical economic theory predicts, privatisation leads to higher costs via higher borrowing costs, dividends paid to shareholders and CEO wages paid at market rates. This undermines the least cost business case for infrastructure, undermining Australia’s comparative advantage. The CoA confirms that comparative advantage trade theory has been replaced by rent extraction.

Recommendation 38 on housing assistance – a push for the feds to have state and territory governments fund and manage this issue was a common theme in the review. In terms of revenue, the states are expected to implement their own income taxes to cover these additional costs. Compounding the pressure was the recommendation the GST be distributed on a per capita basis. As Saul Eslake pointed out on The Drum last night, this will hurt the poorer states of South Australia and Tasmania who with lower populations and large landmasses will need to charge higher income tax rates to cover their overall costs. This will impinge upon their economies and further drain productive capacities.

On state responsibilities, Michael Pascoe said it well:

For all their whingeing about vertical fiscal imbalances, the states already have plenty of responsibility for trashing their own tax bases. Having ditched death duties, they routinely whittle away at their pay roll taxes and refuse to use their powers to get serious about land tax – removing all exemptions – while continuing with their inferior, inequitable stamp duties.

On housing, no mention was made of the need for capital gains tax (despite RP Data reporting housing – land – prices were up 12% nationally, 16.7% in Sydney in 12 months) or negative gearing reform. We agree that NRAS was ineffective, but cutting funding to the homeless would be cruel.

On the intergenerational front, there is much to comment on. I will focus on education – the CoA recommends a reduction in grants to education institutions from 59 to 45% whilst increasing the average proportional cost paid by students from 41 to 55%. This will all but wipe out any chance of a student on an average wage saving up for a deposit on their home before the age of 40. This is compounded by the push for higher HELP repayments, set to incorporate the government borrowing rate as well the cost of bad debts and administration costs. Additionally, the threshold for HELP repayments will be slashed from $51,309 per year to the minimum wage of $32,354. The rise in part time jobs offers little security for banks.

More handouts for rent seekers were delivered in the pharmaceutical benefits scheme. The recommendations include ‘streamlining approvals for new drugs through the Therapeutic Goods Administration process by recognising approvals made by certain overseas agencies.’ Big Pharma will be the big winner – a certain payoff for the US-Aust bilateral trade agreement. Sitting behind this move are the pharma campaign contributions and their control of the US Food and Drug Administration, as this quote from the Journal of Law, Medicine and Ethics clarifies (via Forbes):

“The forthcoming article in JLME also presents systematic, quantitative evidence that since the industry started making large contributions to the FDA for reviewing its drugs, as it makes large contributions to Congressmen who have promoted this substitution for publicly funded regulations, the FDA has sped up the review process with the result that drugs approved are significantly more likely to cause serious harm, hospitalizations, and deaths.”

Australia’s domestic sovereignty further undermined.

Proposed Medicare reform is another obvious attack on the commons. Much has been written about this point.

It’s a sad state of affairs when Gina Rinehart, Harry Triguboff and Ron Walker are given the green light to continue pursuing the type of (unearned) income so lucrative for developers and politicians, as revealed in the New South Wales ICAC corruption inquiry.

Instead, the sick, the poor and the productive will be forced to pay for these necessary oversights to maintain ‘the Australian way’. We implore the public to study the power of economic rents, the unearned incomes driving the wealth gap. Pressure must be applied to politicians to make them understand the motivations so prevalent at ICAC filter through to budgetary and fiscal policy.

Surely studying these forces of modern warfare is less painful than living a life in a two speed economy?