Last week I offered a solution to the blight caused by vacant or disused sites in central Melbourne. Everyone is diminished by landowners leaving valuable land unused while they agitate for rezoning profits.

The Age’s Bruce Guthrie hopped into the discussion for a hand-wringing but offered no solution.

The problem would be reduced by council using its rating power properly – moving from basing rates on the value of land and buildings to the land only.

There is another player in this derelict taxing equation: the Victorian Government.

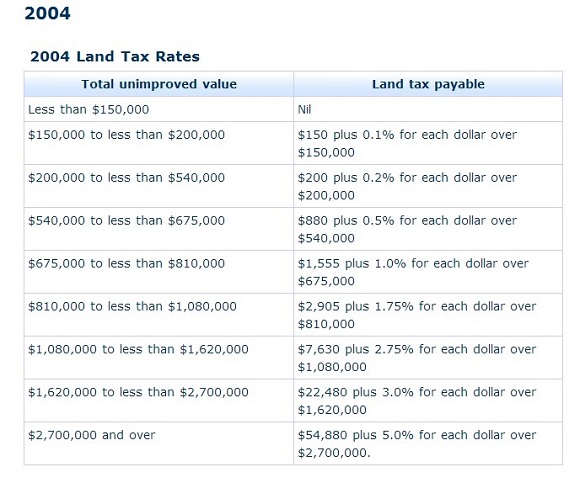

Between 2004 and 2009, under the Bracks and Brumby ALP governments, State Land Taxes were cut firmly. In 2004, the top rate was 5 per cent on total land holdings over $2.7 million.

By 2009, the rates had been more than halved to 2.25 per cent on total landholdings over $3 million. The changes saved commercial and industrial property owners $1,000 million over five years.

“There has been a significant escalation in property prices, probably more than we expected or any government could have expected. The majority (of people paying land tax) are at the low end (of the scale) . . . but there is a problem as some people have moved through the rates and also the valuation of their property or their investment enterprise has gone up.” Premier Bracks said in 2004.

How anyone owning over $2.7 million in taxable land – remember, principal place of residence is exempt – and enjoying significant capital gains could be regarded as deserving charity escapes me.

2,300 land tax payers benefited from this deeply compassionate gesture by Premiers Bracks and Brumby. The rest of Victoria’s 5.6 million people now have to pay more in tax or endure lesser services.

Students of the history of the Australian Labor Party would know the angry, steely determination of earlier labor leaders to ensure rentiers and major landowners paid their fair share of the cost of government, through eminently fair and economically efficient land taxation.

Premier Napthine’s Treasurer Michael O’Brien is looking for quality revenue sources to plug the black hole in the state’s budget. Here is one. And he could drive the development of these awful eyesores.

A full rate of land taxation at this time is in the order of 6% (~ interest rate applicable). So peak land tax is in the region of 38% of the available resource, and most land well under that.

Even leaving aside the issue of sliding rates (idiots) the maximum value needs to be at least 50% of the current cost in order to correct the market. For commercial property this is probably somewhere in the region of 4.5% rather than 2.25%. For residential it should be at least 3%.

Ideally that gets extended all the way down.

It seems intitutional government has shifted from placing the welfare of the Australian nation to the welfare of a minority(investors} for political agendas. Such agendas only breeds corruption such in the form of ‘subsidies’, ‘FHB grants’ and ‘negative gearing’. This only increases the debt of all Australians while a minority make fortunes at our expense. Its time for institutional government to place the welfare of ALL!! Australians first again and the voter to make sure they do

Good article. Politicians are gonna have a hard time explaining why GST, superannuation or income taxes apparently need to rise, or why there needs to be large scale cuts in government expenditure, when the pink elephant in the room – land squatting for passive gains – is completely ignored and ridiculously lightly taxed.

I challenge anyone to find someone in the top 50 rich list in Australia who has not currently, or in the past, held extremely large land holdings which have made them rich due to passive squatting, or due to mining the minerals therein. You won’t find anyone – land and resources is the common theme everywhere to getting rich passively, or in other words, off natural resource rents or the sweat of the 99%.

Its time to jack up land and resource rent tax rates and do away with over 100 other taxes as recommended by Henry and simplify the system. There have been too many years of outright theft by the landed gentry, with taxes far too high on BOTH capital and labour.

Accessing land should be a common right, not require debt serfdom for decades until the heel of the oppressive financiers.

Its time the bankers were seriously downsized and did some actual work for a change – preferably with Kenny, emptying temporary porta-loos at large outdoor events, where bad Indian curry is being served in large helpings…

http://www.theage.com.au/articles/2004/04/20/1082395854877.html

This cited article contains the following quote, staggering in its hypocrisy and incompetence for a so-called “Labour” government:

“Mr Bracks said the Government was slashing land tax to encourage investment in property and in property-related jobs.”

Hadn’t Bracks ever heard that payroll tax is a tax on jobs? Obviously he’d never heard that reducing land tax just generates windfall capital gains for land owners.

The clowns are in charge of the asylum.

so-called “Labor” government.

Sorry.